Tata Motors CV Arm Listing Date Officially Revealed

Tata Motors has confirmed the stock exchange listing date for its commercial vehicles (CV) division, marking a major milestone in its restructuring plan. The move aims to unlock shareholder value and sharpen focus on the CV and passenger vehicle (PV) segments independently. Here’s a breakdown of the key details and implications.

Listing Date and Share Allocation

The CV business will debut on [insert date] under the new entity name [insert name]. Existing Tata Motors shareholders will receive shares in the demerged entity at a ratio of [insert ratio, e.g., 1:1], as approved by regulators. The demerger is expected to:

– Enhance operational efficiency for both businesses.

– Attract niche investors favoring CV or PV exposure.

– Potentially boost valuations due to streamlined operations.

Why Tata Motors Split Its CV and PV Businesses

The demerger reflects the distinct market dynamics of the two segments:

– CV Segment: Cyclical, tied to economic growth, freight demand, and infrastructure.

– PV Segment: Consumer-driven, with strong EV adoption (e.g., Tata Nexon EV).

Benefits of the Split:

1. Targeted Growth Strategies: Each unit can prioritize R&D and expansion.

2. Investor Appeal: CV arm’s market leadership (~45% MHCV share) may draw long-term bets.

3. Financial Flexibility: Independent funding and partnerships.

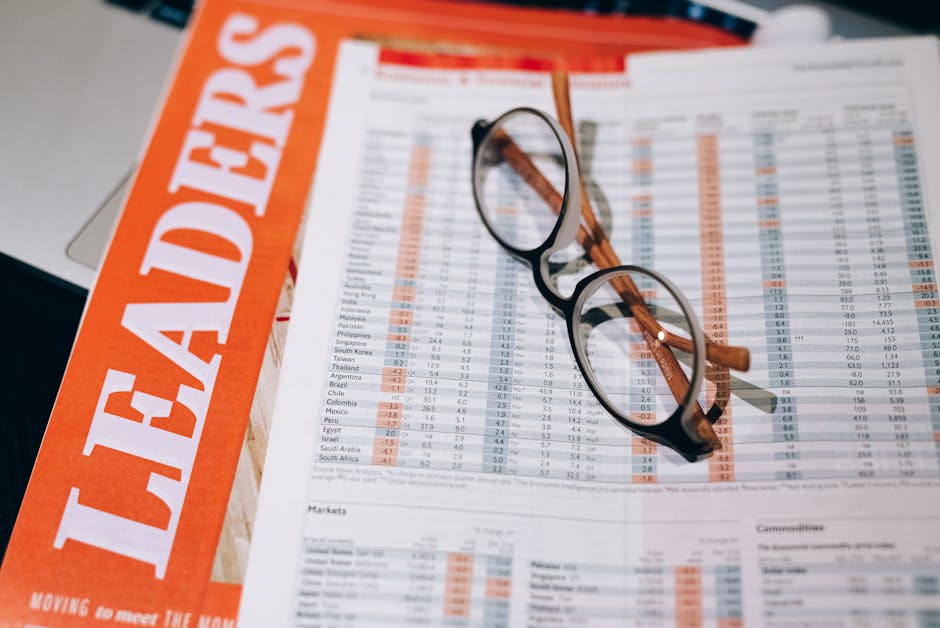

Market and Analyst Reactions

Analysts lauded the move, citing Tata Motors’ CV division as a key player in India’s logistics boom.

“This demerger allows both businesses to leverage their strengths separately,” said [Analyst Name] of [Firm]. “The CV arm’s revival amid infrastructure spending makes it attractive.”

Steps for Shareholders

- Check Demat Accounts: New shares will be credited automatically.

- Review Tax Implications: Consult a financial advisor for clarity.

- Monitor Listings: Watch for trading symbols and opening prices.

Future Outlook

The CV industry is rebounding, fueled by:

– Government infrastructure projects.

– Shift to cleaner fuels (CNG, electric trucks).

– Replacement demand post-pandemic.

Tata Motors’ CV arm is poised to lead this recovery, while the PV business accelerates its EV dominance.

Conclusion

The listing marks a strategic shift for Tata Motors. Investors should stay updated on filings and market trends to capitalize on this transition.

Disclaimer: This content is informational. Seek expert advice before investing.