Bessent’s 2026 Economic Outlook: No Recession, but Sector Risks Loom

Renowned economist and market strategist Scott Bessent has shared his insights on the 2026 economic landscape, striking a balance between optimism and caution. While he dismisses fears of a recession, he warns that certain industries could face significant challenges.

Why Bessent Rules Out a 2026 Recession

Bessent, founder of Key Square Capital Management and a former Soros Fund Management executive, believes the U.S. economy will avoid a recession in 2026. He cites strong consumer spending, stable corporate earnings, and ongoing technological advancements as key stabilizing factors.

“The fundamentals remain robust,” Bessent stated. “Unless a major geopolitical crisis emerges, a recession is unlikely.”

His view contrasts with some analysts who point to high interest rates and debt burdens as potential threats. However, Bessent argues that central banks, particularly the Federal Reserve, have improved their ability to manage economic cycles without triggering downturns.

Industries Facing Headwinds in 2026

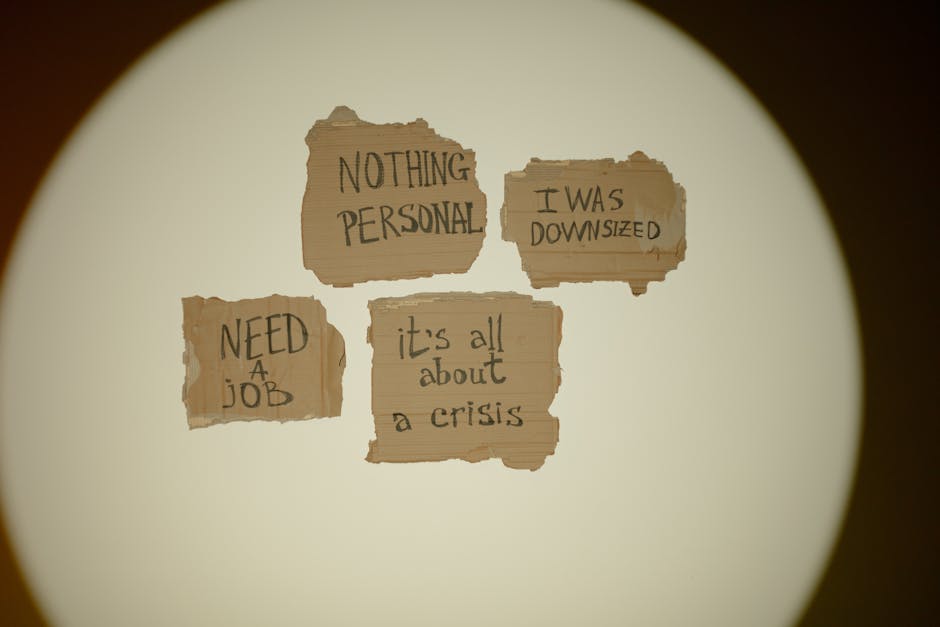

Bessent identifies four high-risk sectors:

-

Commercial Real Estate (CRE)

Remote work trends have led to rising vacancies, declining property values, and stress on regional banks with heavy CRE exposure. -

Traditional Retail

Brick-and-mortar stores struggling with e-commerce competition and shifting consumer habits may see further closures. -

Legacy Automotive & Fossil Fuels

Slow adoption of EVs and renewables could hurt automakers and energy firms reliant on outdated models. -

Regional Banking

Tighter regulations and fintech competition may squeeze smaller banks, especially if loan defaults rise.

Growth Sectors: Where to Invest in 2026

Despite challenges, Bessent highlights opportunities in:

– Technology (AI, Cloud Computing) – Continued innovation and efficiency gains.

– Healthcare & Biotech – Aging populations and medical breakthroughs driving demand.

– Green Energy – Government incentives fueling solar, wind, and battery storage projects.

India’s Economic Prospects

India’s tech and manufacturing sectors are well-positioned, but traditional industries like textiles may struggle. Key policy priorities include:

– Expanding digital infrastructure.

– Accelerating renewable energy adoption.

– Strengthening financial oversight to mitigate real estate and banking risks.

Key Takeaway: Prepare for Diverging Trends

Bessent’s analysis underscores the importance of sector-specific strategies. While the broader economy appears stable, businesses must adapt to sectoral shifts to avoid pitfalls.

For more expert insights, follow NextMinuteNews.